- Ticker Tea

- Posts

- 📊 Launch Edition: MAG7 Earnings, FOMC & Oil Headwinds

📊 Launch Edition: MAG7 Earnings, FOMC & Oil Headwinds

it feels silly writing this given my subscriber count is… 1 (shoutout to my fiancé).

that said, i’m thrilled to be launching this platform. as a no-nonsense news junkie, i’m confident this publication will eventually provide alpha to an audience that is focused on market-related news.

a busy week ahead:

◾ earnings: 5 of the “mag7” are releasing earnings (ER calendar below)

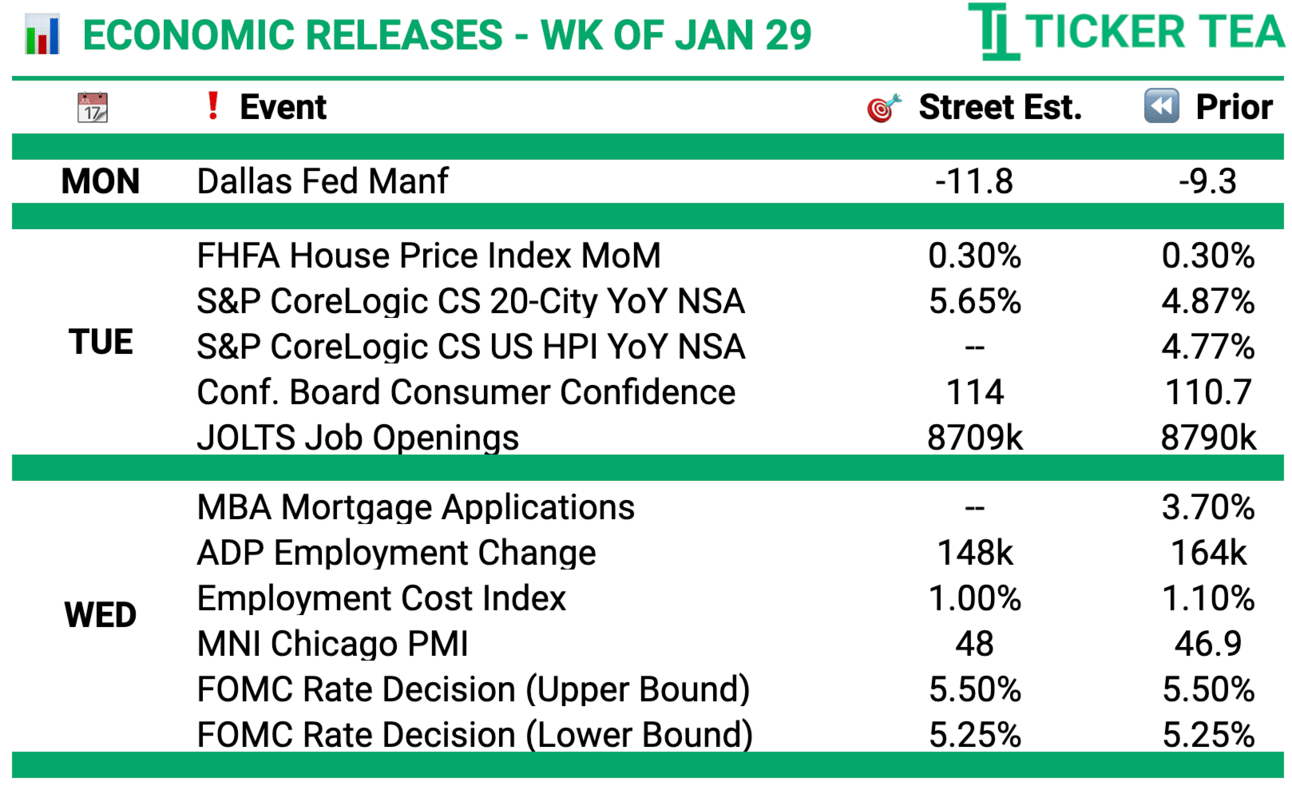

◾ economic data: manufacturing data, ADP, JOLTS, FOMC rate decision, UofMich consumer sentiment + others (economic release calendar below)

◾ tension in the middle east pressuring oil prices

◾ the China Evergrande saga continues…shares were halted Sunday evening on the back of Hong Kong court orders liquidation

◾ Reddit IPO, Blackstone AI aspirations and big pharma headwinds below 👇

◾ investors are keenly focusing on this week's earnings reports from five of the “mag7” - Microsoft ($MSFT), Alphabet ($GOOGL), Meta ($META), Amazon ($AMZN) and Apple ($AAPL), with a combined value over $10T, alongside the Fed's interest rate decision. the outcomes are critical for the S&P 500's direction, as these tech giants have been key drivers of the market's recent rally, fueled by the AI boom and investor anticipation of relaxed monetary policies.

◾ oil prices surged following separate attacks in the Middle East, escalating regional tensions. iranian-backed militants killed US troops in Jordan and struck a fuel tanker in the Red Sea, intensifying geopolitical risks. brent crude rose by 1.5% in early trading on Sunday. these incidents put pressure on President Biden to confront Iran and raised concerns about the security of oil supply and global trade in a region crucial for a third of the world's oil.

◾ the Fed is approaching a critical decision on interest rates, with investors anticipating a potential rate cut in March. Powell's upcoming presser is highly significant, as it may provide insights into the Fed's reaction to recent economic data. inflation has slowed to 2.9% (truflation ~1.8%), while consumer spending remains strong, posing a complex scenario for the Fed. upcoming economic data, including the monthly jobs report and consumer confidence, will further influence this decision-making process.

◾ China Evergrande Group ($3333.HK) has received a liquidation order from a Hong Kong court, marking a significant moment in China's ongoing property debt crisis. the order halts trading of Evergrande shares and leads to the company being managed by provisional liquidators. this development reflects the failure of Evergrande, once the country's largest builder, to restructure its massive debts, totaling 2.39 trillion yuan ($333B).

◾ Reddit is considering a valuation of at least $5B for its upcoming IPO, as advised by early investor meetings. despite private trades currently valuing the company below $5B, the final IPO valuation hinges on the market's recovery. the San Francisco-based firm and its advisers are targeting a mid-single-digit billion valuation, with a potential listing as early as March.

◾ the US government is proposing a rule requiring cloud service providers like Amazon ($AMZN) and Microsoft ($MSFT) to disclose foreign clients (eyes on China) developing AI applications. this initiative aims to address national security concerns by identifying potential uses of AI for malicious cyber activities. the rule would place the responsibility of monitoring and reporting on the cloud companies, akin to the financial industry's KYC regulations. the proposal reflects ongoing efforts to limit China's access to advanced technologies, including AI and semiconductors.

◾ Blackstone ($BX) is aggressively expanding into AI-driven data center operations with its $10B acquisition of QTS, making it North America's largest provider of leased data center capacity. the expansion, part of a $25B investment, faces challenges like high power demands and community concerns over environmental and economic impacts.

◾ major pharmaceutical companies like Bristol Myers ($BMY), Merck ($MRK), and Johnson & Johnson ($JNJ) are facing imminent patent cliffs, risking tens of billions in sales as patents on key drugs expire by 2030. this opens the market to cheaper generics and biosimilars, although some firms are preparing by enhancing drug pipelines and strategic acquisitions to mitigate revenue losses.

monday earnings releases listed below. full list for the week is here

today’s economic releases include Dallas fed manufacturing data, which is expected to decelerate at a fairly significant clip. tomorrow will be focused on JOLTS. at this stage in the cycle, good news is bad news. meaning, its less likely the fed will cut rates with positive economic data. full calendar of events here

Upcoming Economic Data Releases

we are what we repeatedly do.

excellence, then, is not an act, but a habit

Aristotle

Reply