- Ticker Tea

- Posts

- Reddit Faces Harsh Market Reality as Hedgeye Predicts 50% Share Price Dive

Reddit Faces Harsh Market Reality as Hedgeye Predicts 50% Share Price Dive

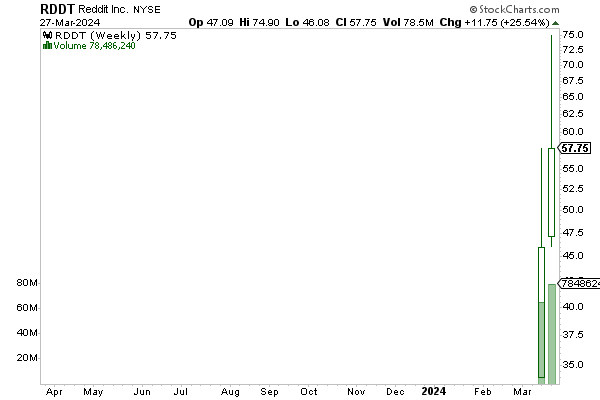

📝 SUMMARY: Reddit Inc. ($RDDT), the social media giant known for its vibrant communities and role in numerous market phenomena, encountered a harsh reversal in fortunes on Wall Street, marking its biggest one-day fall since going public. Hedgeye Risk Management’s damning assessment labeled Reddit as a prime short-sell candidate, anticipating a 50% plummet in its stock value from its peak. This projection sent shares tumbling down 11% to close at $57.75, a stark contrast to the euphoria following its March 21 IPO that saw the stock climb over 90% to an all-time high of $65.11.

Hedgeye's analysis paints a picture of a company currently riding the wave of initial public offering success but headed for a valuation correction. Despite Reddit's refusal to comment on the matter, the analytical firm backed its stance with observations of an overvaluation, arguing for a price adjustment back towards the IPO level of $34. This bold prediction follows a period of rapid gains fueled by Reddit’s promising start in the public domain, supported by investors’ growing appetite for AI-driven ventures, positioning Reddit's IPO among the largest in the US for 2024.

The market’s initial reception of Reddit underscored a broader enthusiasm for technology and AI, offering a glimmer of hope for tech entities eyeing public listings after a period of hesitation. However, Hedgeye’s Andrew Freedman casts a shadow on this optimism, cautioning about the volatile nature of newly public companies like Reddit. While acknowledging potential short-term growth, Freedman’s outlook remains skeptical for the latter half of 2024 and into 2025, predicting a deceleration in user and revenue growth that could undermine Reddit’s current market standing.

As Reddit gears up to unveil its first quarterly results as a public entity, the market watches closely, balancing between initial successes and Hedgeye’s forewarnings of an impending correction, showcasing the volatile interplay between market expectations and the realities of growth trajectories.

Reply