- Ticker Tea

- Posts

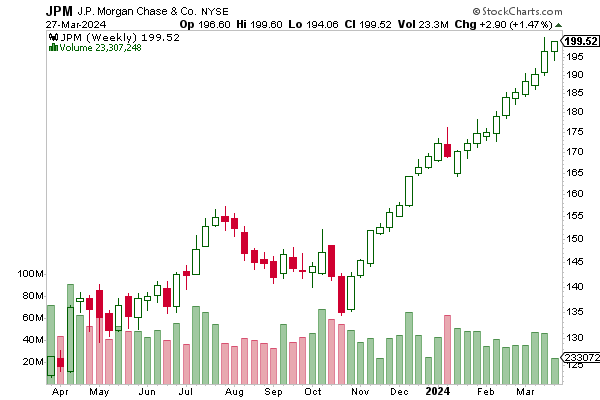

- JPMorgan Cautions on Crowded Stocks: A Precarious Peak in US Equities

JPMorgan Cautions on Crowded Stocks: A Precarious Peak in US Equities

📝 SUMMARY: In a landscape of seemingly unending market highs, JPMorgan Chase & Co.'s ($JPM) chief global equity strategist, Dubravko Lakos-Bujas, strikes a cautionary tone, suggesting the current rally in US equities might be more fragile than it appears. Amidst the concluding days of a prosperous first quarter, with the S&P 500 ($.INX) poised for a significant return, Lakos-Bujas alerts investors to the lurking dangers of momentum trading and the pitfalls of an overly concentrated investment in the market's best performers.

The strategist’s concerns stem from the "excessive crowding" in these top stocks, which he believes could precipitate a sudden and dramatic sell-off, akin to past flash crashes. This viewpoint is especially poignant as the market enjoys its fifth month of gains, buoyed by robust corporate earnings, burgeoning AI excitement, a resilient US economy, and anticipatory rate cuts by the Federal Reserve.

Lakos-Bujas’s unease is not without reason. The market's current successes, from earnings to regulatory outlooks and speculative political impacts, may already be fully reflected in stock prices, leaving little room for positive surprises. Instead, the risk spectrum seems increasingly populated by potential negatives. This is underscored by recent history, which shows a pattern of corrections following rushes into popular momentum stocks, with notable plunges in high-profile companies like Tesla ($TSLA) and Apple ($AAPL) serving as harbingers.

In a stark departure from Wall Street's prevailing bullishness, JPMorgan maintains a conservative stance, projecting a nearly 20% drop in the S&P 500 by year-end, the most bearish forecast among major banks. This skepticism extends from last year's optimistic predictions during a market downturn, through to a cautious outlook amid the previous year's rally, underscoring a consistent message of prudence and risk awareness in an environment where many are inclined toward exuberance.

Reply