- Ticker Tea

- Posts

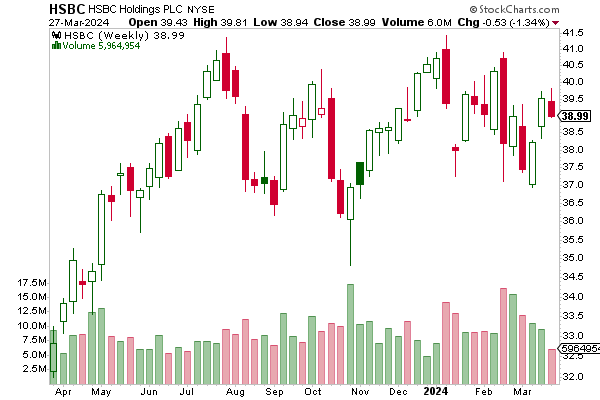

- HSBC's Gerry Keefe Counters Carson Block's Bearish Real Estate Forecast

HSBC's Gerry Keefe Counters Carson Block's Bearish Real Estate Forecast

📝 SUMMARY: HSBC Holdings Plc’s ($HSBC) Gerry Keefe, co-head of global banking, has publicly disagreed with renowned short seller Carson Block's bleak prediction for the commercial real estate (CRE) market. In a Bloomberg Television interview, Keefe suggested that the worst for the CRE market is in the past, contrasting Block’s comparison of the current real estate situation to the pre-2008 financial crisis atmosphere. Keefe believes the bottom of the market was likely reached in the fourth quarter, citing the extreme negativity towards the asset class as a bottoming signal.

Keefe dismissed Block’s comments as typical of a short seller’s perspective, maintaining that HSBC is "comfortable" with its current exposure to commercial real estate. This confidence comes after HSBC reported a significant reduction in its US CRE portfolio, which saw a 27% decrease in exposure to $3.9 billion as part of its strategy to de-risk its holdings, as noted by HSBC CEO Noel Quinn.

Beyond real estate, Keefe highlighted an optimistic outlook for infrastructure, suggesting that the sector is entering a "golden age" of project finance. This boom is supported by substantial capital flows from Asia and the Middle East, regions eager for investment opportunities. Reflecting this positive market sentiment, HSBC plans to bolster its workforce, potentially adding around 200 bankers to meet growing demands, particularly in lucrative areas like AI investment in the Middle East.

Keefe's stance underscores HSBC’s broader confidence in the financial markets, especially in the United States, where he describes it as "go-time." While acknowledging complexities in global markets, Keefe points to significant investment initiatives in the Middle East as indicative of the opportunities that lie ahead, positioning HSBC to leverage these trends for future growth.

Reply