- Ticker Tea

- Posts

- 📊 Fed Up

📊 Fed Up

Mornin’ ☀️

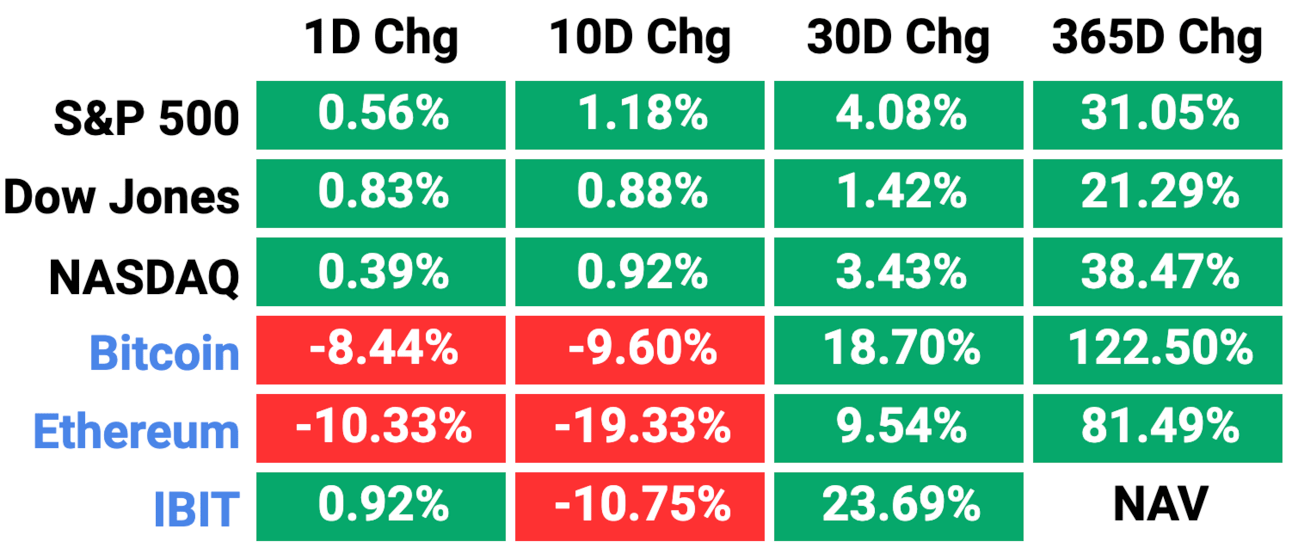

Yesterday major indices all recorded gains, with the S&P 500 reaching a 1-week high. This uplift in the market was partly fueled by a robust rally in energy stocks (link to screener) , spurred on by a significant rise in WTI crude oil prices to a 4-1/2 month high. Additionally, a strong demand for a $13 billion Treasury bond auction led to lower Treasury note yields, further boosting the market.

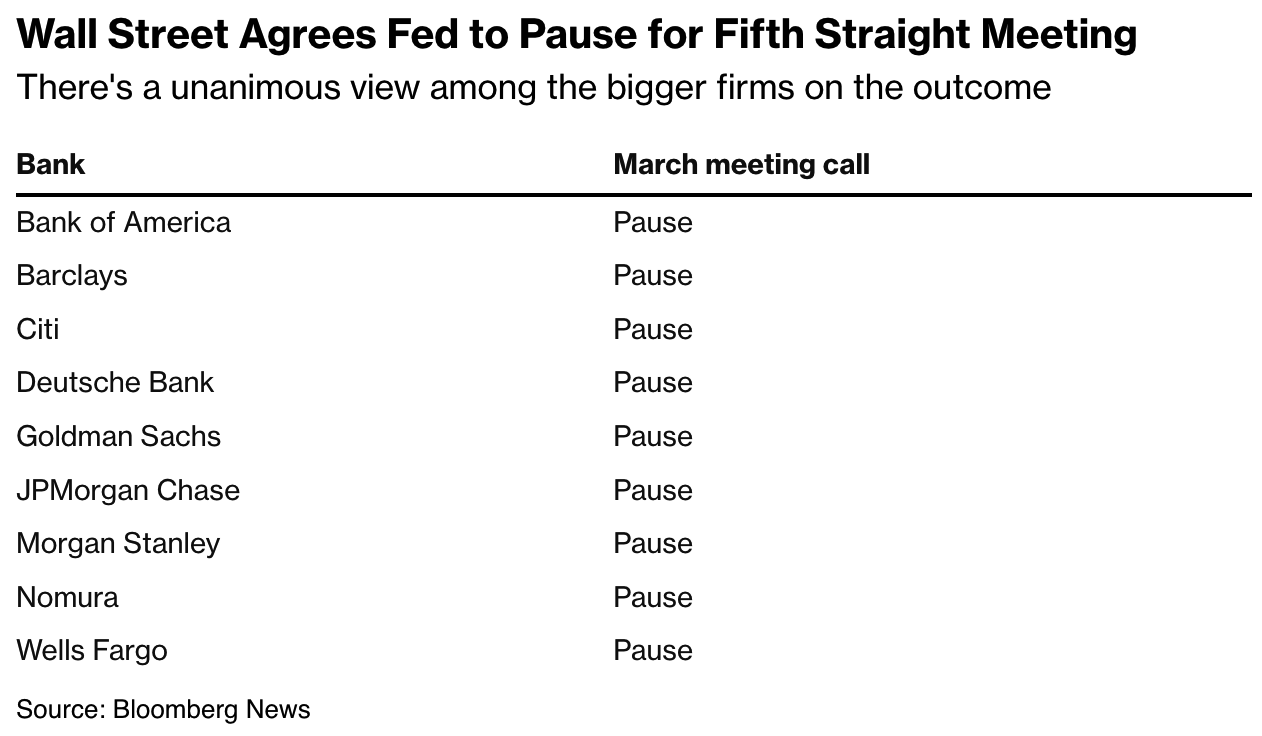

Market focus today will be on the Federal Reserve's two-day FOMC meeting that began yesterday. There is a general expectation that the Fed will maintain its federal funds target range at 5.25%-5.50%. Investors are keenly awaiting the Fed's updated projections (more info on the “dot plot”: link) and comments from Powell's press conference for clues on future rate cuts. The market is currently pricing in ~3 rate cuts this year with some market participants convinced that will decrease to 2 following the presser.

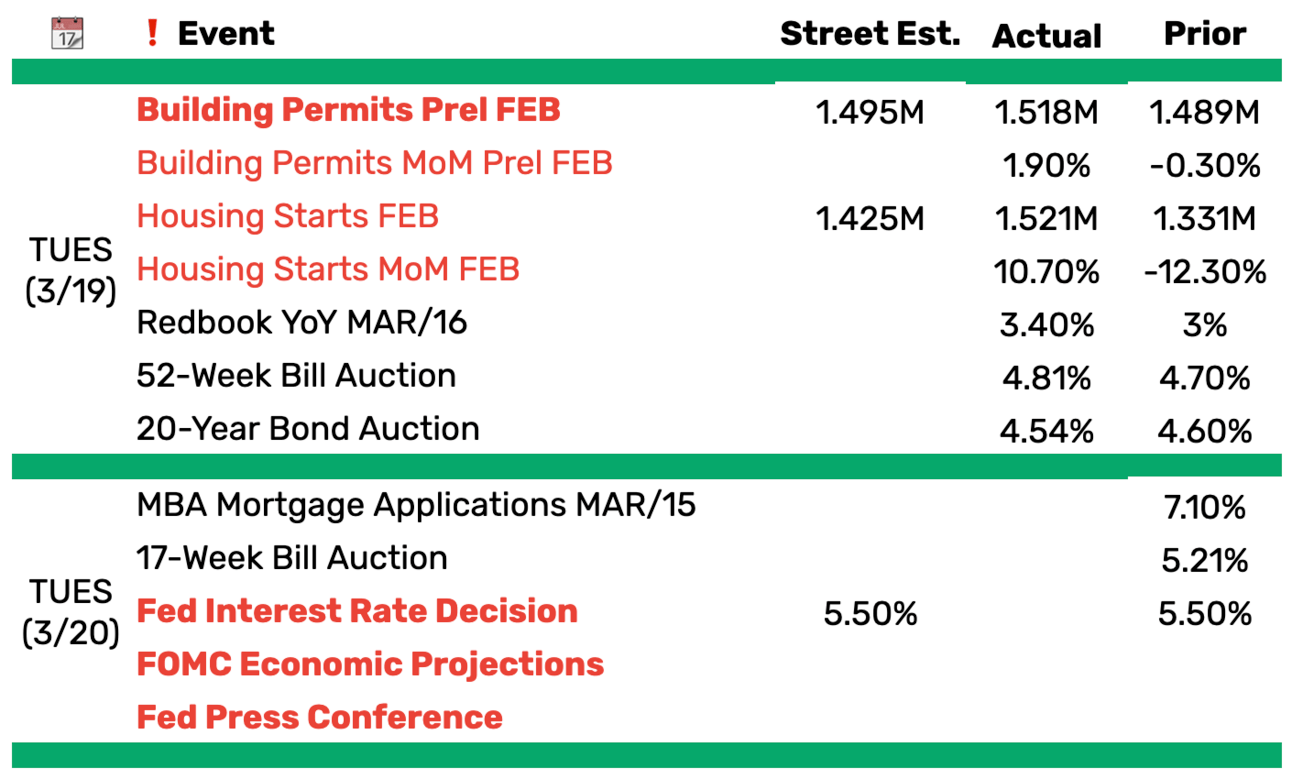

Positive developments in the housing sector, with February housing starts and building permits exceeding expectations, have provided an optimistic backdrop for the market, providing further ammo for the Fed to keep rates higher for longer.

Bitcoin experienced a significant downturn (see below), amid signs of long liquidation pressures, further highlighting the diverse factors influencing market dynamics.

⬆️ Gainers: Gildan (+10%), Nordstrom (+9%), Avis (+7%), Embraer (+7%) (link)

⬇️ Losers: SMC (-9%), Planet Fitnesss (-5%), Robinhood (-5%) (link)

Were you forwarded this email? Subscribe here

» Nordstrom's ($JWN) stock soared 9% after reports surfaced about the retailer's latest bid to transition to a private entity, with the founding family engaging advisors to gauge interest from private equity. Amid retail sector challenges and a cautious sales forecast for 2024, this move marks a significant turn in Nordstrom's strategy to revitalize its business. (link)

» The Commercial Real Estate CLO market, crucial for financing speculative real estate ventures, is facing severe strain with delinquency rates soaring past 7.4% amid rising interest rates and a cooling $20 trillion US commercial real estate sector. This distress signals a broader systemic risk, spotlighting the fragile balance of speculative debt in an already teetering market. (link)

» As Reddit prepares to list on the NYSE with the symbol $RDDT, it earmarks 8% of its IPO shares for its most active users, betting on community goodwill to navigate its public debut. This strategy unfolds against a backdrop of mixed sentiments among Redditors, some of whom express skepticism, highlighting the platform's challenge in balancing user engagement with financial viability. (link)

» The real estate industry faces a seismic shift as the National Association of Realtors' recent settlement paves the way for changes in commission structures, potentially altering how agents are compensated. Amidst this upheaval, realtors grapple with adapting to new payment models or seeking alternative career paths, signaling a transformative period for home buying and selling. (link)

» The remnants of the 2023 regional banking crisis linger as high interest rates threaten the stability of hundreds of smaller banks, with a slow merger market offering little relief. Approximately 282 banks face the dual threats of significant commercial real estate exposure and unrealized losses from the rate surge, placing them in a precarious position that could lead to capital raising or mergers. (link)

» The Federal Reserve's "dot plot" is a quarterly chart that plots members' forecasts for the federal funds rate over the next three years and beyond, providing insight into the Fed's monetary policy direction. It influences investor expectations and market movements, despite criticisms regarding its anonymity and the lack of a unified consensus among Fed officials. (link)

» Nvidia's ($NVDA) shares experienced a rebound, closing up 1% after unveiling its groundbreaking Blackwell AI chips, signaling a stronger foothold in the $250 billion data center market. CEO Jensen Huang's emphasis on Nvidia's unique market-creating software alongside its cutting-edge hardware has reinvigorated investor confidence and analyst optimism. (link)

» Amid anticipation for the Federal Reserve's rate decision, Wall Street saw the S&P 500 reach unprecedented highs, propelled by a significant rally in big tech companies, notably Nvidia ($NVDA). This surge is underpinned by investor confidence in economic growth and inflation normalization, despite mixed sentiments about the market's rapid ascent and AI stock valuations. (link)

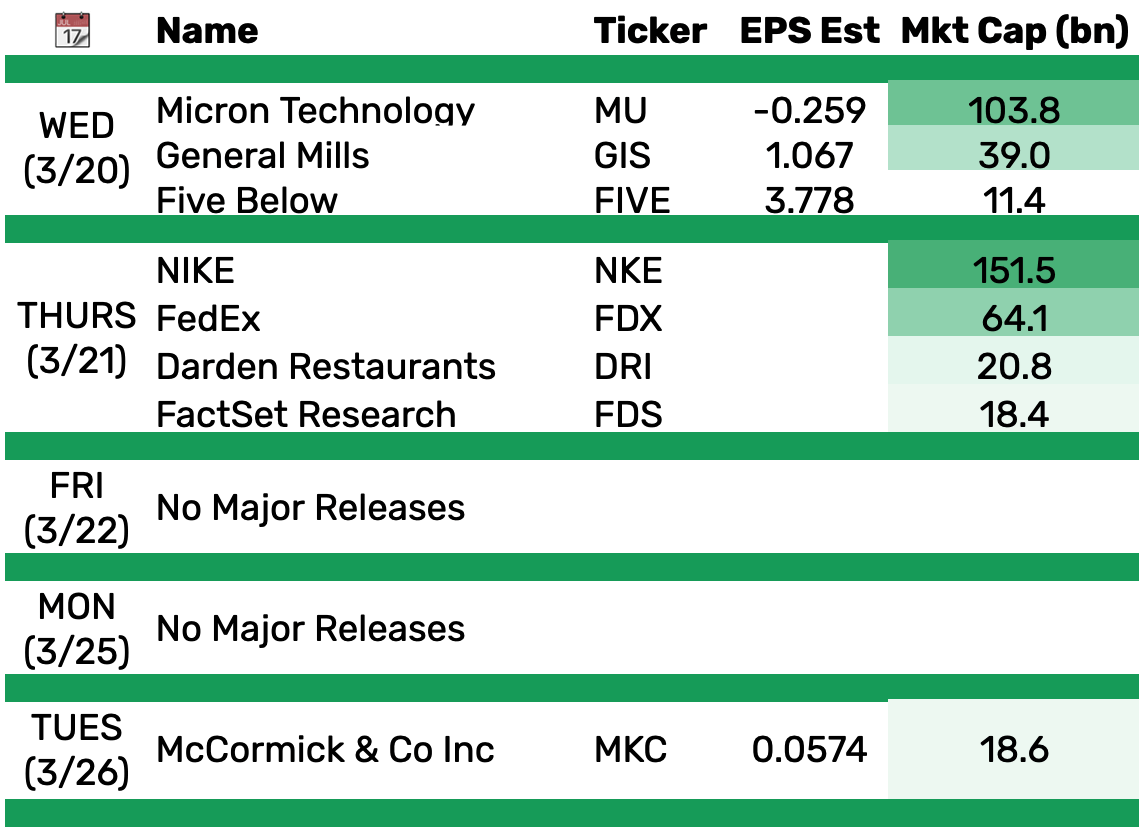

Major earnings releases scheduled the next five business days 👇

Click here for a comprehensive list of earnings scheduled over the next 5 days (mkt cap $1bn+)

Economic results from yesterday are below, along with today’s schedule 👇 Click here for full schedule & live updates of Wall Street estimates.

If you set your goals ridiculously high and it's a failure, you will fail above everyone else's success.

James Cameron

Reply to this email & let us know how we can improve (difficult to read, too long, dry, etc.)

How was this edition of Ticker Tea? |

Reply