- Ticker Tea

- Posts

- 📊 Fading Odds for Rate Cuts

📊 Fading Odds for Rate Cuts

Yesterday, major indices closed higher, driven by Cintas's +8% jump after upbeat Q3 results and raised FY24 guidance, Merck & Co.'s +4% rise following FDA approval of its new drug, and nCino's +18% surge with strong Q4 earnings and optimistic FY25 forecast. GameStop, however, plummeted over -15% due to disappointing Q4 results.

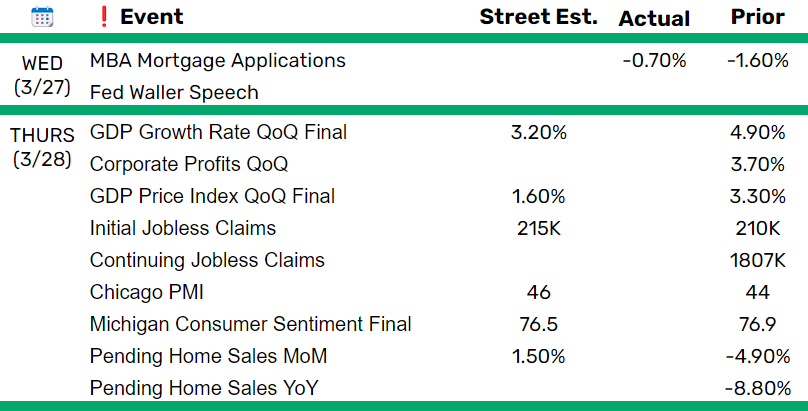

Fed Gov Waller sees no immediate need to cut interest rates, calling for better inflation data before considering reductions. Market expectations for Fed policy adjustments remain, with rate futures indicating low chances of cuts in the upcoming meetings. The focus shifts to the U.S. core personal consumption expenditures price index data and speeches from Fed officials this Friday.

Today, investor attention is on the final U.S. GDP figure for the fourth quarter, expected at +3.2%, and the upcoming U.S. Chicago PMI, with predictions of a slight improvement in March.

Were you forwarded this email? Subscribe here

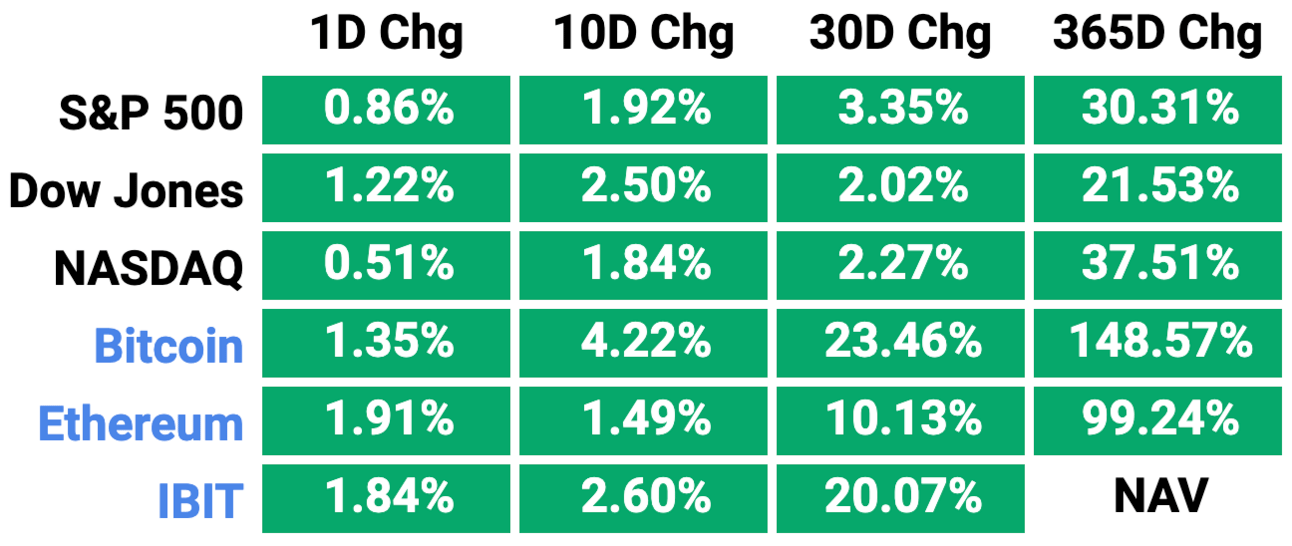

» The S&P 500 achieved a new record close, up 10% for the quarter, defying inflation concerns and showcasing strong market resilience. Institutional investors' quarterly rebalancing is expected to offload approximately $32 billion in stocks, according to Goldman Sachs ($GS). (link)

» After an initial surge post-IPO, Reddit ($RDDT) experienced its most significant single-day decline following Hedgeye Risk Management's report, branding it a short sell with a potential 50% drop in value. The firm views Reddit as "grossly overvalued," suggesting a fair price closer to the $34 IPO mark, contrary to recent highs. (link)

» Dubravko Lakos-Bujas of JPMorgan Chase ($JPM) warns of the high risk of a market correction due to overcrowding in top-performing stocks, despite the S&P 500's 10% first-quarter gain. The firm's bearish outlook contrasts with Wall Street's optimism, highlighting potential vulnerabilities amid a five-month rally. (link)

» DraftKings ($DKNG) saw its shares plummet following the NCAA's announcement to push for a ban on college proposition betting, affecting the wider sports betting sector. Despite the regulatory challenges, analysts believe the ban's financial impact on DraftKings will be minimal, given such bets constituted only 1.4% of total wagers in 2023. (link)

» Gerry Keefe of $HSBC refutes Carson Block’s pessimistic view on the commercial real estate market, signaling confidence in the sector's recovery. Despite reducing its CRE exposure, HSBC sees a bright future, particularly in infrastructure finance, and plans to expand its workforce. (link)

» A study suggests Ozempic, Novo Nordisk's diabetes drug priced nearly at $1,000 in the US, could be manufactured for less than $5 monthly, including profit. This discrepancy has reignited discussions on drug pricing, particularly for treatments for diabetes and obesity. (link)

» Spindrift Beverage, known for its sparkling water and low-calorie alcoholic lemonade, is considering various strategic directions, including a potential sale. The company, boasting annual net sales over $300 million, is seeking interest from potential buyers with the help of advisers. (link)

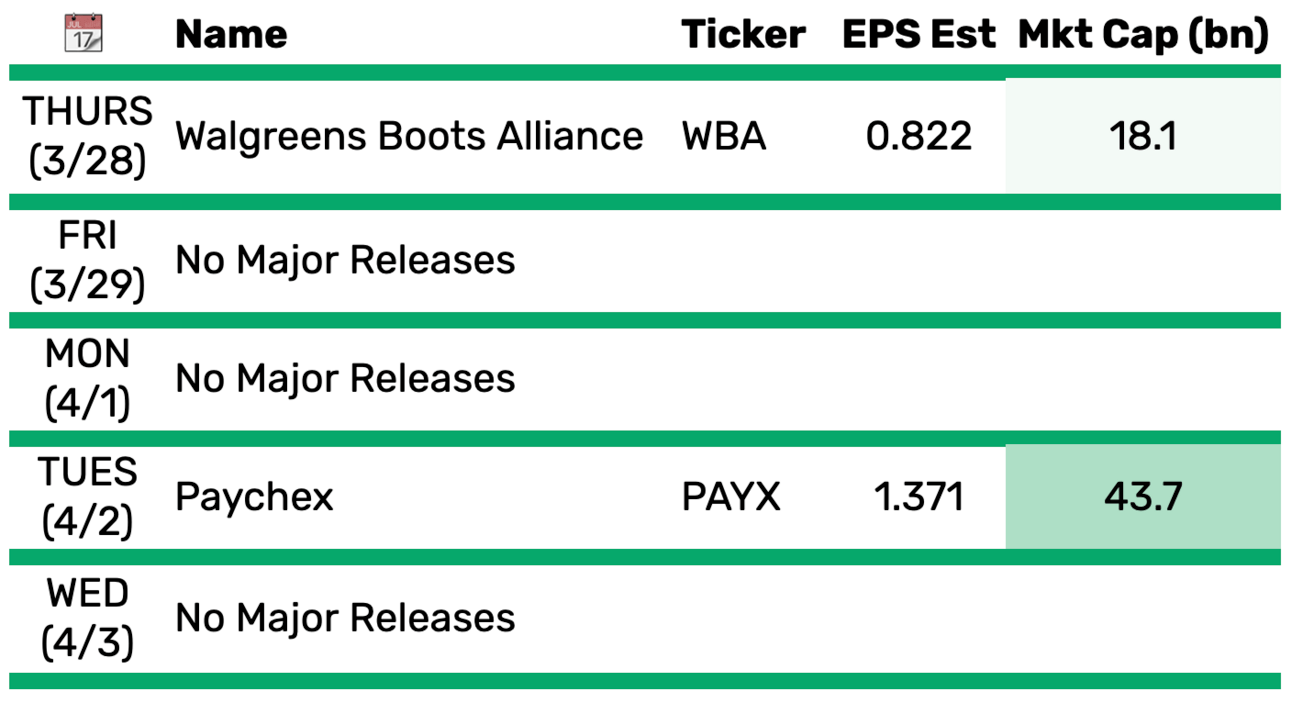

Major ($10bn+) earnings releases scheduled the next five business days 👇 Click here for a comprehensive list of upcoming earnings releases

Results from yesterday’s economic releases & today’s schedule below 👇 Click here for full schedule & live updates of Wall Street estimates.

Once you face your fear, nothing is ever as hard as you think.

Olivia Newton-John

Reply to this email & let us know how we can improve (difficult to read, too long, dry, etc.)

How was this edition of Ticker Tea? |

Reply