- Ticker Tea

- Posts

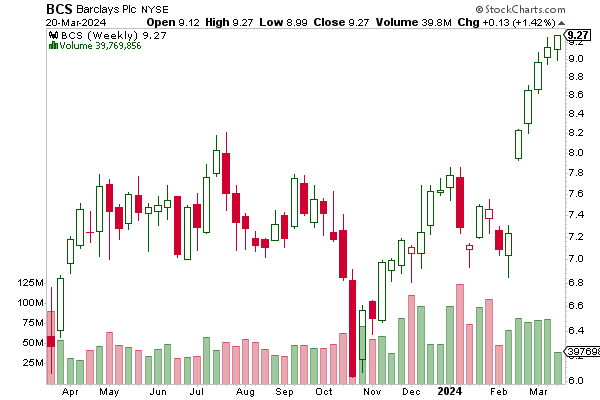

- Barclays Sharpens Focus, Announces Job Cuts in Investment Banking Division

Barclays Sharpens Focus, Announces Job Cuts in Investment Banking Division

📝 SUMMARY: Barclays Plc ($BCS) is undertaking a significant restructuring within its investment banking division, signaling a move to cut several hundred jobs as the bank strives to enhance operational efficiency and profitability. This decision affects various sectors within the division, including global markets, research, and investment banking, marking a continuation of the bank’s annual practice of evaluating and trimming underperforming staff. This strategic shift comes amid a broader pattern of job reductions across Wall Street, with industry giants such as Citigroup Inc. ($CITI) and JPMorgan Chase & Co. ($JPM) making similar adjustments in response to a notable downturn in dealmaking and capital market activities.

The restructuring initiative is part of Barclays' long-term strategy to revamp the investment banking division's profitability, which has been impacted by decreased market activity and a high attrition rate among dealmakers. CEO C.S. Venkatakrishnan has emphasized the bank's commitment to reshaping its investment bank to yield higher returns, focusing on enhancing advisory and equity underwriting services, and targeting sectors poised for growth, such as financial sponsors and energy companies transitioning away from greenhouse gas emissions.

Despite the focus on trimming costs within the investment bank, Barclays plans to invest in other areas of its operations, including its UK-centric services and US credit-card business, without allocating additional capital to the investment banking sector. The bank aims to reduce its cost-to-income ratio significantly by 2026, underscoring a commitment to growth and contribution from the investment bank while ensuring it utilizes less capital.

This strategic recalibration has caused unease among investment bank staff, further exacerbated by a challenging bonus season and efforts to mitigate high attrition rates through selective compensation adjustments. Venkatakrishnan reaffirms the investment bank's pivotal role within Barclays, highlighting the necessity for the division to achieve higher returns and occupy a relatively smaller portion of the bank’s portfolio, ensuring its alignment with the broader strategic vision for growth and efficiency.

Reply