- Ticker Tea

- Posts

- Amazon Set to Join Dow Jones Industrial Average, Replacing Walgreens

Amazon Set to Join Dow Jones Industrial Average, Replacing Walgreens

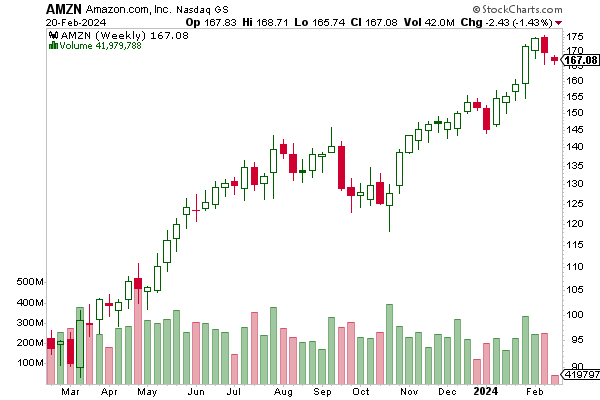

📝 SUMMARY: In a notable shift within the financial markets, Amazon ($AMZN) will replace Walgreens Boots Alliance ($WBA) in the Dow Jones Industrial Average ($.IDJ), a pivotal change announced by S&P Dow Jones Indices that underscores the evolving dynamics of the American economy. The inclusion of Amazon in the DJIA, effective prior to the market opening on February 26, marks a significant step in acknowledging the expansive role of technology and online retail in the modern economic landscape. This adjustment is partially triggered by Walmart's 3-for-1 stock split, which reduced its weight in the index, prompting a realignment to better reflect current market realities.

Amazon's integration into the DJIA not only highlights its dominance as the leading online retailer but also acknowledges its substantial contributions to cloud computing, advertising, and other sectors. Under the leadership of Andy Jassy, who succeeded founder Jeff Bezos in 2021, Amazon has cemented its status as a cloud market leader, contributing significantly to its revenue and operating profit. The company's advertising business, in particular, has shown remarkable growth, outpacing that of other tech giants like Alphabet, Meta, and Microsoft in the fourth quarter.

The decision to include Amazon in the Dow Jones follows the earlier addition of Salesforce ($CRM), Amgen ($AMGN), and Honeywell International ($HON), reflecting the index's ongoing efforts to adapt to the changing economic environment. Meanwhile, Walgreens, a Dow component since 2018 after replacing GE, has shown a narrowing of losses in its recent quarterly report, highlighting the diverse financial health and strategic directions of companies within the DJIA.

Amazon's entry into the Dow Jones Industrial Average symbolizes a broader recognition of the significant impact of e-commerce and technology on the global economy, further entrenching the company's influence and offering investors increased exposure to the consumer retail sector through the DJIA.

Reply