- Ticker Tea

- Posts

- Adam Neumann's Rocky Road to Reclaim WeWork Amid Financing Hurdles

Adam Neumann's Rocky Road to Reclaim WeWork Amid Financing Hurdles

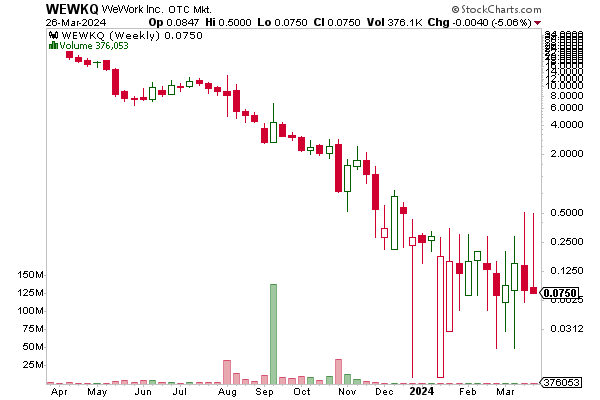

📝 SUMMARY: Adam Neumann's attempt to repurchase WeWork ($WEWKQ), the office-sharing giant he founded and was ousted from, is mired in uncertainty. His preliminary $500 million offer to acquire the company from bankruptcy is fraught with financial and reputational hurdles. Despite his ambitions, there's skepticism around Neumann securing the necessary funding, with sources indicating that prior named financiers, such as Dan Loeb’s Third Point ($TPNTF) and Baupost Group, have not materialized in support of his bid.

Rithm Capital ($RITM), having shown initial interest, is still in the early stages of due diligence, and its commitment remains unconfirmed. This situation mirrors Neumann's past endeavors, where announced financial backers did not follow through, casting doubt on the viability of his current proposal. The challenge is compounded by Neumann's history of extravagant spending and fundraising that led to his departure ahead of WeWork's failed IPO attempt in 2019, damaging his reputation and investor trust.

Moreover, Neumann has not enlisted financial advisors or bankers for his bid, an unusual move for such a significant acquisition effort. His involvement with Flow, a new venture that is part of the bidding entity for WeWork, adds another layer of complexity to the proceedings. With venture capital firm Andreessen Horowitz as a significant investor in Flow, the connections between Neumann's past and present endeavors blur further.

The timing of Neumann's offer coincides with a critical juncture in WeWork’s bankruptcy process, with the company not actively seeking bids but focusing on restructuring. This approach, combined with the secured creditors' priorities, which include major investor SoftBank ($9984), makes the success of Neumann's bid highly uncertain.

Neumann's journey to regain control of WeWork is emblematic of the broader challenges of navigating corporate comebacks and restructuring, underscoring the intricacies of bankruptcy proceedings and the importance of clear financial backing and creditor support.

Reply