- Ticker Tea

- Posts

- 📊 A Hole-y Alliance: Krispy Kreme + McD

📊 A Hole-y Alliance: Krispy Kreme + McD

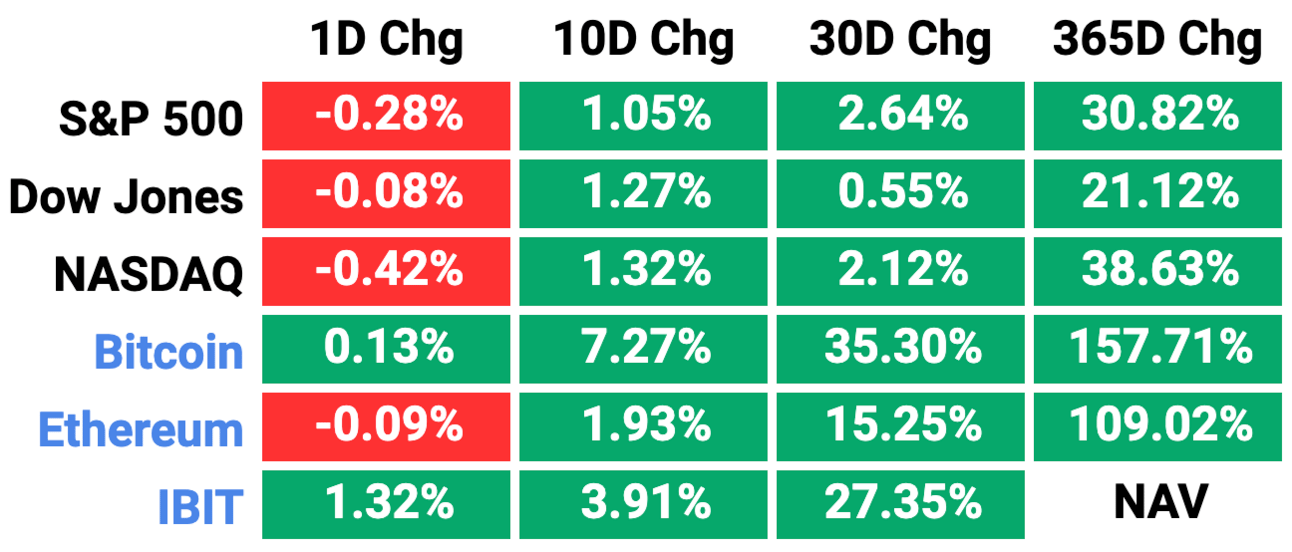

Yesterday major indices experienced declines. The market's early gains were erased, partly due to a significant drop in Nvidia shares (chart), which led to a broader slide in technology stocks, particularly those in the semiconductor industry.

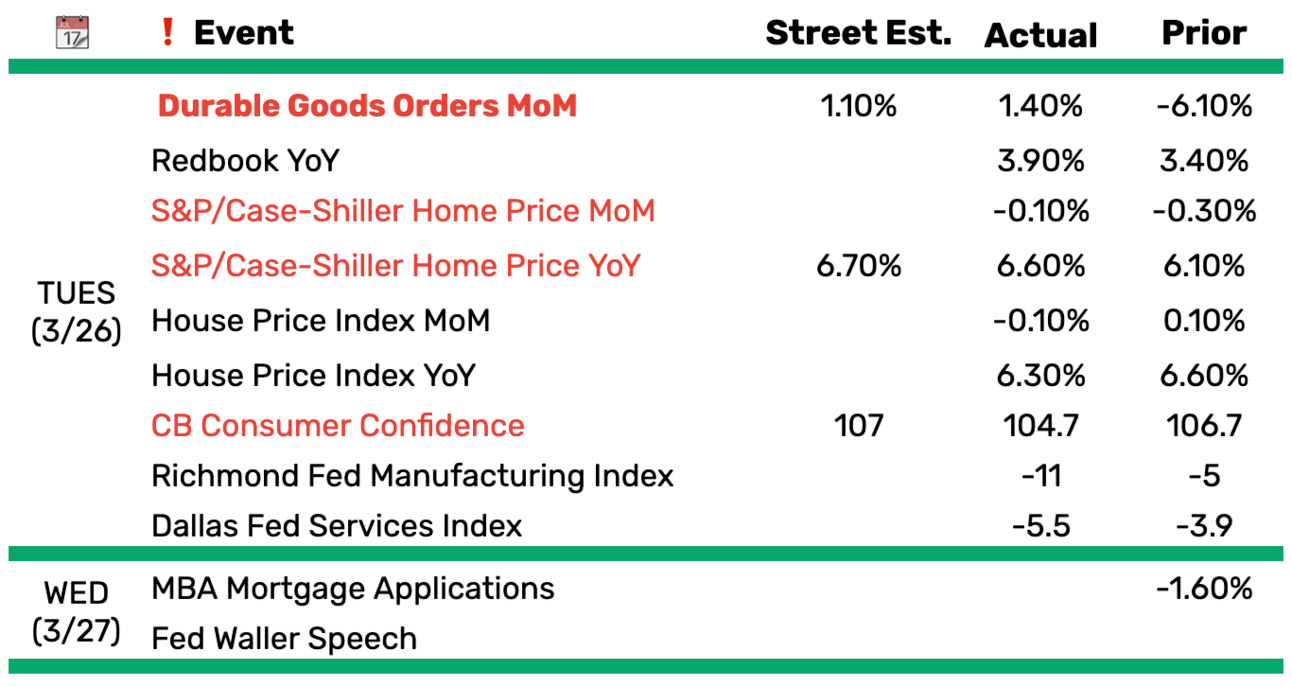

Economic indicators released on y’day showed a mixed picture for investors. On a positive note, Feb saw a stronger-than-expected increase in orders for capital goods, signaling robust corporate spending on equipment. However, this positive data was offset by a decrease in consumer confidence to a four-month low, alongside an unexpected dip in the Richmond Fed manufacturing survey, highlighting potential concerns about the U.S. economic outlook.

A flurry of individual equity news hit the screens:

** UPS: -8%, disappointing 2026 revenue forecast; BofA cites historical overestimation. (chart)

** MMM: -2%, $6B settlement for earplug lawsuit sees >99% participation. (chart)

** NVDA: -2%; drag on chip sector with GFS -2%, AVGO, TXN, KLAC, MCHP all >-1%. (chart)

** CSX: -1%, impacted by Baltimore bridge collapse affecting terminal services. (chart)

** TSLA: +2%, potential talks with Italy for electric truck production. (chart)

** DNUT: +39%, partnership for nationwide sale in McDonald’s. (chart)

** VKTX: +16%, positive Phase 1 obesity treatment trial results. (chart)

** PRAX: +23%, successful mid-stage epilepsy treatment trial. (chart)

⬆️ Gainers: Krispy Kreme (+40%), Viking Therapeutics (+17%), Trump Media & Technology (+16%), Rumble (+15%), Reddit (+9%) (list of top gainers)

⬇️ Losers: Goosehead Insurance (-10%), UPS (-8%), Arm Holdings (-7.5%), Canada Goose (-7%) (list of top losers)

Were you forwarded this email? Subscribe here

» Stocks on Wall Street erased their gains in the final 30 minutes of trading amid quarter-end portfolio rebalancing, marking a sudden downturn for the S&P 500 after a $4 trillion rally this year. This shift reflects growing investor caution, even as American shares eye a five-month winning streak, amidst concerns over elevated stock valuations. (link)

» After debuting on Nasdaq with the ticker $DJT, Trump Media & Technology Group's stock surged over 50%, reflecting significant investor interest amidst volatile trading. The company, associated with Donald Trump and valued at $8.4 billion mid-afternoon, boasts a high market cap despite minimal revenue and substantial losses. (link)

» Retail investors drive meme stock surge, buoyed by Fed signals and recent events like GameStop ($GME) and Reddit’s ($RDDT) IPO. Strong options trading volume suggests potential gains, echoing 2021's enthusiasm. Despite warnings, retail traders dive in, chasing high returns. (link)

» S&P Global Ratings downgraded its outlook on five US regional banks due to challenges in the commercial real estate sector, signaling potential declines in asset quality and performance. While interest rate cuts could offer relief, prolonged high rates pose significant risks. (link)

» Cocoa prices have soared to a record $10,080 per metric ton, driven by a severe supply deficit, adverse weather, and disease in West Africa, posing significant challenges for chocolate production. Consumers may face higher prices and "shrinkflation" as the industry grapples with the largest cocoa supply gap in over six decades, with the worst impacts expected by late 2024 or early 2025. (link)

» The collapse of the Francis Scott Key Bridge has led to the shutdown of the Port of Baltimore, triggering a logistical scramble as logistics companies reroute imports and exports to other East Coast ports. This incident could cause significant shifts in cargo flows, impact various industries, and lead to increased transportation costs and delays. (link)

» Adam Neumann's $500 million bid to buy WeWork ($WEWKQ) out of bankruptcy faces significant challenges, including doubts about financing and support from creditors. Despite interest from investment firms like Rithm Capital ($RITM), Neumann's history with the company and the complexity of the bankruptcy process complicate his efforts. (link)

» McDonald’s ($MCD) plans to sell Krispy Kreme ($DNUT) doughnuts across its US locations by the end of 2026, becoming the exclusive fast-food partner for Krispy Kreme in the nation. This strategic partnership, starting in the second half of this year, aims to double Krispy Kreme’s distribution capacity, propelling its shares up by 39%. (link)

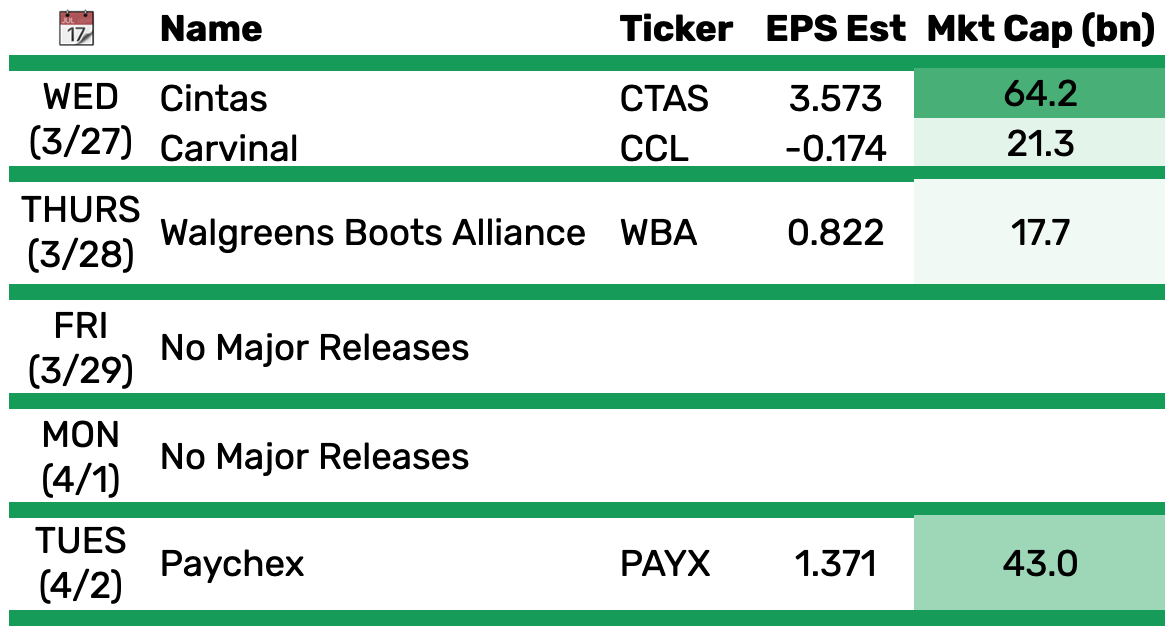

Major ($10bn+) earnings releases scheduled the next five business days 👇 Click here for a comprehensive list of upcoming earnings releases

Results from yesterday’s economic releases & today’s schedule below 👇 Click here for full schedule & live updates of Wall Street estimates.

“It is our attitude at the beginning of a difficult task which, more than anything else, will affect its successful outcome.”

William James

Reply to this email & let us know how we can improve (difficult to read, too long, dry, etc.)

How was this edition of Ticker Tea? |

Reply